Cash is the lifeblood of any business but for SMEs in Nigeria, maintaining liquidity is a constant challenge. One misstep and payroll goes unpaid, suppliers demand cash, or a key client delays payment. That’s where the 13-week rolling cash flow template saves you from financial surprises.

In this article, you’ll discover:

-

What a 13-week rolling cash flow model is

-

Why Nigerian SMEs need it

-

How to build one step-by-step (with a free template)

-

Best practices, pitfalls, and how Zaccheus can help

Let’s dive in.

1. What Is a 13-Week Rolling Cash Flow Model?

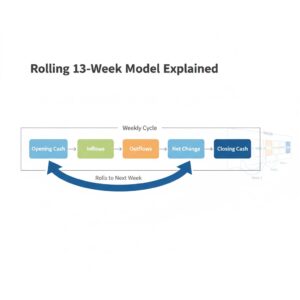

A 13-week rolling cash flow model is a forecast tool that projects cash inflows and outflows weekly over the next 13 weeks (roughly one fiscal quarter). It is “rolling” because every week you drop the past week and add a new future week, keeping your forecast horizon constant.

Unlike monthly forecasts, weekly granularity gives you sharper visibility into timing of receipts and payments essential when cash is tight.

Key sections typically include:

-

Opening cash balance (for each week)

-

Cash inflows (sales receipts, loans, refunds, etc.)

-

Cash outflows (salaries, rent, suppliers, interest, taxes, etc.)

-

Net change (inflows minus outflows)

-

Closing cash balance (which becomes next week’s opening)

You may also include reconciling items like working capital roll-forwards (Accounts Receivable, Inventory, Accounts Payable).

Why 13 Weeks?

-

It’s short enough to be reasonably accurate (because projections further out tend to be error-prone).

-

It covers one full quarter, aligning with reporting cycles.

-

The rolling aspect keeps it up to date and responsive to real business changes.

However, it’s not ideal for long-term strategic planning beyond 3 months. As your business scales, you’ll complement it with monthly or yearly forecasts.

2. Why Nigerian SMEs Should Use It

Here are reasons why this model is critical for SMEs operating in Nigeria:

. High Cash Volatility & Tight Liquidity

Many Nigerian SMEs face irregular payments, forex rate swings, fluctuating input costs, and delays from clients. A weekly forecast helps you catch potential shortfalls before you run dry.

. Early Warning & Decision Time

If your model shows a negative balance in Week 8, you have time (2–3 weeks) to accelerate receivables, defer expenses, or negotiate bridging loans.

. Stronger Credibility with Lenders & Investors

Demonstrating that you can forecast and manage liquidity builds trust with banks, investors, or grant providers. Deloitte notes a robust 13-week forecast helps monitor debt covenants and engage stakeholders.

. Better Cash Discipline & Accountability

When your team knows that every invoice and payment decision feeds into weekly liquidity, it encourages more careful budgeting, timely collections, and tighter supplier negotiation.

. Aligns with Short-Term Realities

Long-term budgets are useful, but in volatile markets, the near term matters most. The 13-week model bridges daily cash management and annual budgeting.

3. Step-by-Step: Building Your 13-Week Cash Flow Template

Here’s how to build (or adapt) a 13-week rolling cash flow model for your SME. You can use Excel, Google Sheets, or any spreadsheet tool.

a. Define Time Horizon & Structure

-

Label columns for 13 consecutive weeks (e.g. Week 1, Week 2, … Week 13).

-

Below that, include sections: Opening Cash, Inflows, Outflows, Net Change, Closing Cash.

-

Optionally, add subsections: AR roll, Inventory, AP roll, accruals.

b. Map Cash Inflows

-

Collections from sales: Based on your receivables schedule. Estimate how much of invoiced sales will be collected in each week.

-

New sales / recurring revenues: Predict weekly or monthly and allocate to weeks.

-

Other inflows: Loans, grants, refunds, asset sales, interest income.

Tip: Use historical data (e.g. last 3 months) to estimate collection patterns (e.g. 30%, 60%, 90 days).

c. Map Cash Outflows

Break your outflows into predictable, discretionary, and variable categories:

-

Fixed / committed costs: Rent, salaries, insurance, loan interest, etc.

-

Variable costs / COGS: Supplier payments, raw material purchases.

-

Discretionary or one-time costs: Marketing campaigns, equipment, maintenance, etc.

-

Other payments: Taxes, dividends, capital expenditures, etc.

Where possible, estimate when the payment will occur (i.e. which week), not just the amount.

Also include any working capital adjustments:

-

Use AR roll-forward to see how AR changes week to week.

-

Use AP schedule for when you pay suppliers.

-

Inventory purchases that may precede sales.

d. Compute Net Flow & Update Weekly

-

Net Cash Flow = Total Inflows − Total Outflows

-

Closing Cash = Opening Cash + Net Cash Flow

-

Next week’s Opening Cash = This week’s Closing Cash

Each week, replace the oldest week with a new projection week. Insert actual results for past weeks.

You should also include variance tracking (i.e. forecast vs actual) to refine your assumptions.

4. Customizing for Nigeria: FX, Payment Delays & Seasonality

To make the model realistic for Nigerian SMEs, you should adjust for:

. Exchange Rate & USD Inputs

If you pay for raw materials or services in dollars (or other foreign currency), build an FX forecast line (e.g. Naira per USD) and convert costs accordingly. You might also buffer for FX depreciation warps.

. Receivables Delays & Nonpayment Risk

Clients may delay payments beyond terms. Consider a “bad debt buffer” or sliding delays (e.g. 10% of AR falls 2 weeks late). Adjust your collections curve accordingly.

. Seasonality & Market Trends

Many sectors in Nigeria have high seasonality (e.g. agriculture, retail). Model weekly ramp ups/dips (e.g. holiday season) in sales and adjust working capital accordingly.

. Inflation & Price Fluctuations

Because inflation is high, some costs may escalate mid-quarter. You may incorporate inflation adjustment (e.g. 2–5% per month) into your variable cost lines.

. Local Taxes, Levies & Regulatory Costs

Include periodic regulatory fees or local government levies that might not be monthly but quarterly or annually.

5. Best Practices & Common Mistakes

Here are guidelines to make your model robust and useful, and avoid common pitfalls:

Best Practices

-

Update weekly: Make it part of your finance cadence.

-

Use realistic assumptions: Base your inflow/outflow patterns on actual history.

-

Use scenario planning: Best case, base case, worst case.

-

Maintain a minimum cash buffer line: Don’t go to zero — aim to preserve a safety cash floor.

-

Track variance: Compare forecast vs actual and adjust assumptions.

-

Keep a “management commentary” line: Notes on reasons for deviations, upcoming risks.

-

Ensure alignment across departments: Sales, procurement, operations must buy into assumptions.

Common Mistakes to Avoid

-

Overly optimistic collections (assuming 100% on time)

-

Ignoring FX or inflation adjustments

-

Lump-summing irregular payments without allocating timing

-

Forgetting to drop older weeks (i.e. not rolling)

-

Not adjusting assumptions when real numbers deviate

-

Not involving non-finance teams, leading to unrealistic estimates

6. How Zaccheus (AI CFO) Augments This Process

While a spreadsheet template is useful and essential for understanding and discipline, managing a 13-week rolling forecast manually can become tedious as your business scales. Here’s how Zaccheus (your AI CFO) enhances the process:

-

Automated data ingestion: Connect your bank, accounting system, sales platform, and let Zaccheus pull actuals automatically into the model.

-

Assumption suggestions: Using machine learning, Zaccheus can propose realistic inflow/outflow curves based on your industry, history, and market trends.

-

Automated rolling update & alerts: When a week ends, the model rolls, and if a future week hits a negative balance, it triggers alerts.

-

Scenario simulations: Run “what-if” scenarios (e.g. client delays 30 days, cost inflation spikes, FX shock) and see the impact instantly.

-

Dashboard + narrative commentary: Zaccheus can generate a narrative summary (e.g. “In week 9, you may face a ₦5M shortfall; consider a short-term bridge loan.”)

-

Investor / lender-ready outputs: Produce polished reports, charts, and variance commentary you can send to stakeholders.

In effect, Zaccheus enables you to get the rigor of a 13-week cash flow model with less manual work, fewer errors, and real-time insights.

7. Conclusion & Call to Action

A 13-week rolling cash flow template gives Nigerian SMEs a real, actionable tool to stay ahead of liquidity crunches. It helps you see risk early, build financial discipline, and communicate confidently with investors, banks, or stakeholders.

While the spreadsheet version is essential for learning and control, pairing it with an AI CFO solution (like Zaccheus) elevates your forecasting to real-time, automated, and insight-driven.

FAQ (People Also Ask)

Q1: How often should I update the 13-week rolling cash flow?

You should update it every week. At the end of the week (or start of the next), insert real actuals, shift the window forward by one week, and re-forecast for the new 13th week. This keeps the model current and actionable.

Q2: What if I have more than 13 weeks of forecast need?

You can layer forecasts. Use the weekly 13-week model for liquidity management, and maintain a monthly or quarterly forecast out to 12 months for strategic planning.

Q3: Can I use this model for seasonal SMEs (e.g. agriculture, tourism)?

Yes. You just need to adjust your inflow/outflow patterns to reflect seasonal shifts (e.g. stronger weeks, slow periods). Historical data is key to capturing seasonality.

Q4: What minimum cash buffer should I maintain?

That depends on your business, but many SMEs set a buffer of 3–4 weeks of expenses or a percentage (e.g. 10–20%) of forecasted outflows. The buffer helps you avoid plunging to zero.

Q5: What tools should I use? Excel, Google Sheets or software?

Start with Excel or Google Sheets for flexibility and control. As you grow, transition to automated tools or AI CFO platforms (like Zaccheus) to reduce manual effort, errors, and streamline scenario analysis.

Ready to Take Control of Your Cash Flow?

Building and maintaining a 13-week rolling cash flow model is one of the smartest moves a Nigerian SME can make. But updating spreadsheets, tracking inflows, and chasing payments every week can quickly drain your time and focus.

That’s where Zaccheus comes in your AI CFO built to manage cash flow, forecast liquidity, and make data-driven financial decisions simple.

With Zaccheus, you can:

-

Automatically track your cash position across all accounts.

-

Forecast inflows and outflows in real time, with zero spreadsheets.

-

Get proactive alerts when a cash shortfall is coming.

-

Generate investor-ready reports in minutes, not days.

💡 Join hundreds of founders and finance teams using Zaccheus to stay cash-positive and in control.

👉 Sign up for free at usezaccheus.com and let your AI CFO handle the cash flow headaches while you focus on growth.