If you run a business or freelance gig, you’ve probably been tempted to “just use your personal card this one time.” It seems harmless, right? Unfortunately, mixing personal and business finances is one of the fastest ways to create tax chaos, confuse your records, and lose credibility with clients or investors.

In this guide, you’ll learn why keeping your finances separate is non-negotiable and how to set things up correctly, without needing an accounting degree.

Featured Snippet Answer

Separating personal and business finances means maintaining distinct bank accounts, records, and expenses for your personal life and your business. It ensures accurate bookkeeping, simplifies tax filing, protects personal assets, and strengthens business credibility.

The Dangers of Mixing Personal and Business Finances

Blurring the lines between your personal and business expenses can quickly become a financial nightmare. Here’s why:

-

Tax Confusion: The IRS or local tax authorities expect clear records. Mixed accounts make it hard to prove deductions, increasing your risk of audits or fines.

-

Legal Risks: If your business faces a lawsuit, your personal assets may not be protected if finances are intertwined.

-

Bookkeeping Chaos: Tracking profitability becomes guesswork when personal purchases mix with business expenses.

A simple mistake like using your personal card for a business purchase can make reconciliation a monthly headache.

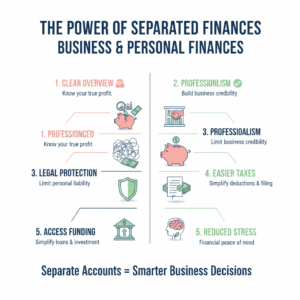

Top Benefits of Keeping Finances Separate

1. Easier Tax Filing and Audit Protection

When your finances are cleanly divided, filing taxes becomes faster and less stressful. You can easily identify deductible business expenses and provide clear documentation if audited.

Example:

A graphic designer with a dedicated business account can instantly pull all her expense reports without sorting through grocery or Netflix payments.

2. Better Cash Flow Clarity

By separating your accounts, you can see exactly how much your business earns, spends, and retains. This helps you make smarter financial decisions and plan for growth.

Pro Tip: Use an AI-powered financial dashboard like Zaccheus to track real-time cash flow and profitability.

3. Stronger Business Credibility

Clients, investors, and banks take you more seriously when your business finances are professional. A separate business bank account shows you mean business literally.

It builds trust, which can lead to easier funding, better partnerships, and a stronger reputation.

4. Simplified Financial Management with AI Tools

Modern founders use automation to stay organized. Tools like Zaccheus AI CFO automatically categorize transactions, generate cash flow insights, and prepare tax-ready reports.

Instead of juggling spreadsheets, you get a real-time snapshot of your company’s financial health.

How to Separate Personal and Business Finances Properly

Here’s a simple step-by-step process to do it right:

-

Open a Business Bank Account — Choose a bank that offers low fees and integrates with your accounting tools.

-

Get a Business Credit Card — Use it only for business-related purchases.

-

Pay Yourself a Salary or Draw — Transfer money from the business to your personal account instead of using the business card for personal needs.

-

Track Every Transaction — Use software or an AI CFO tool to categorize expenses automatically.

-

Save Receipts and Invoices — Keep digital copies for accurate tax filing.

Consistency is key. Once you separate, maintain the discipline.

Common Mistakes to Avoid

-

Using the same card for personal and business spending.

-

Paying personal bills directly from the business account.

-

Forgetting to record owner’s draws or repayments.

-

Mixing Venmo or PayPal accounts for both purposes.

These may seem small but can cause major accounting confusion later.

FAQ

1. Can I use my personal bank account for business?

Technically, yes, but it’s risky. You’ll lose financial clarity and make tax time more complicated. It’s always better to open a dedicated business account.

2. What happens if I mix personal and business finances?

You risk tax penalties, lose expense deductions, and weaken legal protection for your personal assets if your business is sued.

3. How do I track separate finances easily?

Use accounting tools like QuickBooks, Xero, o r Zaccheus, which automate expense tracking and financial reporting.

4. Do freelancers need to separate finances too?

Absolutely. Even if you’re a one-person operation, clear separation helps you understand profitability and stay compliant with tax rules.

5. Can AI help manage business finances?

Yes. Tools like Zaccheus AI CFO can automatically categorize expenses, track cash flow, and simplify reporting, saving hours of manual work.

Conclusion

Separating personal and business finances is not just good practice, it’s non-negotiable. It keeps your taxes simple, your records clean, and your reputation professional.

Start by opening a separate bank account today, and use an AI CFO tool like Zaccheus to automate your financial tracking and gain clarity on your money.

Take control of your business finances with Zaccheus , your AI CFO for smarter decisions.