What Is the Pioneer Status Incentive in Nigeria?

The Pioneer Status Incentive (PSI) is one of the most powerful tax relief programs available to Nigerian businesses. Managed by the Nigerian Investment Promotion Commission (NIPC), this incentive grants eligible companies a 3-year tax holiday, extendable for 2 more years, giving a total of 5 years of exemption from Company Income Tax (CIT).

For startups and SMEs, that means more cash flow, more room to reinvest in growth, and a competitive edge in your market.

The policy was designed to encourage investment in critical sectors of the economy especially those driving industrialization, innovation, and job creation.

Benefits of the Pioneer Status Incentive

Here’s why every eligible Nigerian company should explore the pioneer status Nigeria application process:

-

Corporate Tax Exemption: Up to 5 years free from Company Income Tax obligations.

-

Improved Cash Flow: Freeing up capital for reinvestment, expansion, or R&D.

-

Enhanced Investor Confidence: Tax incentives improve valuation and funding appeal.

-

Encouragement for Innovation: Designed to support emerging industries like tech, renewable energy, and manufacturing.

In short, the PSI helps young and growing companies keep more of their profits, money that can go into scaling the business.

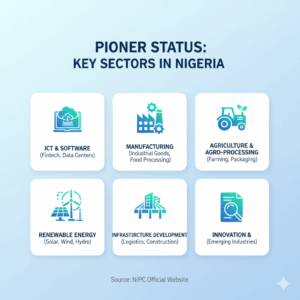

Industries Eligible for Pioneer Status in Nigeria

Not every company can qualify for this incentive. The NIPC publishes a detailed list of eligible industries, known as the Pioneer Status List, which is updated periodically.

Some of the key sectors include:

-

Information and Communication Technology (ICT) — software development, fintech, and data centers.

-

Manufacturing — production of industrial goods, food processing, and building materials.

-

Agriculture and Agro-processing — modern farming, packaging, and export-focused operations.

-

Renewable Energy — solar, wind, hydro, and green energy solutions.

-

Infrastructure Development — logistics, construction, and transportation innovation.

You can view the current list directly from the NIPC official website.

If your startup operates in one of these industries, you’re already on the right path toward eligibility.

Pioneer Status Nigeria Application Process

Now that you know what PSI is and why it matters, here’s how to apply step-by-step.

Step 1: Confirm Eligibility

Check whether your business activity appears in the NIPC’s current Pioneer List. You’ll also need to ensure your company:

-

Is registered with the Corporate Affairs Commission (CAC).

-

Has started commercial production or operations.

-

Can prove that it adds value to the Nigerian economy (through job creation, innovation, or local sourcing).

Step 2: Register on the NIPC e-PSI Portal

Visit psp.nipc.gov.ng and create an account. The NIPC now handles all applications digitally.

You’ll need to upload:

-

CAC certificate and incorporation documents

-

Audited financial statements (if available)

-

Project implementation report

-

Evidence of production commencement

Step 3: Pay Application Fee

After submitting your documents, pay the prescribed application and processing fees via the online portal.

-

Application fee: ₦10,000 (non-refundable)

-

Processing fee: ₦200,000 (subject to NIPC updates)

Always confirm the latest fees on the NIPC portal.

Step 4: NIPC Review and Site Inspection

The NIPC will review your submission and may visit your business premises for inspection. This is to confirm that your operations align with the declared industry.

They’ll also assess:

-

Local content contribution

-

Employment generation

-

Export potential

Step 5: Approval and Certificate Issuance

If approved, your company will receive a Pioneer Status Certificate, granting you the tax holiday period. You’ll then need to file annual returns to maintain the status and may apply for an extension before expiration.

Common Mistakes and How to Avoid Them

Applying for pioneer status can be straightforward, but many businesses lose time or get rejected due to avoidable errors.

Here’s what to avoid:

-

Incomplete Documentation: Missing CAC filings, tax returns, or audited accounts delay processing.

-

Wrong Industry Classification: Ensure your company’s business description aligns with the NIPC’s Pioneer List.

-

Poor Financial Records: Unclear or inconsistent financial data can raise red flags.

-

Late Application: You must apply within the eligible production timeline to qualify.

Pro tip: Keeping your accounting organized is key. This is where Zaccheus comes in.

How Zaccheus Simplifies Pioneer Status Readiness

Preparing a pioneer status Nigeria application involves gathering accurate data audited reports, financial statements, tax filings, and compliance documents.

With Zaccheus, your AI CFO, you can:

-

Automatically generate financial statements and reports for NIPC submission.

-

Track tax compliance and due-diligence readiness.

-

Maintain investor-grade reporting for funding and incentives.

Zaccheus eliminates the manual effort, reduces errors, and ensures your startup is compliance-ready at all times.

Key Takeaways

-

The Pioneer Status Incentive gives eligible Nigerian companies up to 5 years of corporate tax exemption.

-

Check if your business is listed under the NIPC Pioneer Industries List.

-

Follow the official pioneer status Nigeria application steps online.

-

Keep your financials and compliance documents ready.

-

Use Zaccheus to automate your accounting and tax preparation.

Conclusion: Apply Smart and Stay Investor-Ready with Zaccheus

The Pioneer Status Incentive is more than a tax break, it’s a growth opportunity for Nigerian startups ready to scale responsibly.

If you believe your company qualifies, start your pioneer status Nigeria application today and enjoy the financial freedom to reinvest in your vision.

Zaccheus helps you get there faster.

With automated accounting, compliance tracking, and investor reporting, Zaccheus keeps your books clean and your business ready for every opportunity including incentives like the Pioneer Status.

👉 Sign up at usezaccheus.com to simplify your financial operations and stay compliance-ready year-round.