Importing transaction data into Excel remains a powerful method for business owners, accountants, and finance professionals to analyze cash flow, reconcile accounts, and build dashboards , all under their control. In 2025, Excel’s tools (especially Power Query / Get & Transform) are more capable than ever for importing, cleaning, transforming, and refreshing transaction data with minimal manual effort.

In this guide, you’ll learn:

-

What sources of transaction data you can import into Excel

-

How Excel’s modern tools (2025 edition) facilitate smart imports and transformation

-

Step-by-step methods, best practices, and tips to automate recurring imports

-

Troubleshooting common issues

If you want to stop copying & pasting bank statements or CSVs month after month, this guide is for you.

What This Topic Means

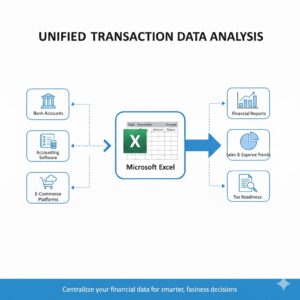

When someone says “How to Import Transactions into Excel,” they usually refer to methods of pulling financial or transactional data (bank statements, accounting software exports, payment gateway logs, point-of-sale data, etc.) into Excel worksheets or data models so that one can:

-

Reconcile transactions

-

Build financial reports (cash flow, profit & loss, etc.)

-

Visualize trends (charts, pivot tables)

-

Combine multiple sources into a unified dataset

-

Automate future updates (so that Excel refreshes when new data arrives)

“2025 Guide” signals that we include the latest Excel features, connector improvements, AI / automation enhancements, and best practices updated to 2025.

Why It’s Important in 2025

-

Better connectors & APIs: Excel in 2025 has improved compatibility with web APIs, more data sources in Power Query, and more reliable refresh capabilities.

-

Automation & “refreshable models”: Instead of manually copy-pasting, you can build import workflows that auto-refresh.

-

Data transformation built in: You can clean, normalize, merge, split, and shape data inside Excel using Power Query (Get & Transform).

-

Scalability: As businesses grow or handle more transactions quarterly, the manual method breaks. Automated imports scale better.

-

Lower error rates and faster insights: Less manual data entry reduces mistakes and enables faster decision-making.

Core Concepts & Tools in Excel for Transaction Imports

Before we dive into steps, familiarize yourself with these key tools:

-

Power Query / Get & Transform: The modern ETL tool inside Excel that lets you connect, transform, and load data from various sources.

-

Queries & connections pane: Where you see all your data sources and queries loaded into your workbook.

-

“Transform” stage: Cleaning, filtering, renaming, changing types, splitting columns, merging tables.

-

Load / Close & Load: After transformation, you push the data into worksheets or data models.

-

Refresh / Auto-refresh: Once set up, you can refresh the query fetch new data and apply the same transformations.

-

M language: The underlying scripting language of Power Query (advanced users can tweak steps).

-

Combining multiple files / append: If you have monthly statements in a folder, you can import and combine them automatically.

Step-by-Step: How to Import Transactions into Excel (2025 Edition)

Here’s a practical workflow you can follow:

Step 1: Choose & Collect Your Source Transaction Files

Your transaction data could come from:

-

Bank statements (CSV, XLSX, OFX formats)

-

Export from accounting software (Xero, QuickBooks, etc.)

-

Payment gateway logs (Paystack, Stripe, etc.)

-

POS or e-commerce systems (Shopify, WooCommerce exports)

-

APIs / web endpoints (if your system supports a JSON/XML feed)

Save them in a folder (if files) or have the API details ready.

Step 2: Use Excel’s “Get Data” / Power Query to Connect

-

Open Excel → go to Data tab → Get Data.

-

Depending on where your source file is:

-

From File → From Text/CSV for CSV exports

-

From File → From Workbook for Excel exports

-

From File → From Folder if multiple files in a folder (e.g. monthly statements)

-

From Web / From JSON / From XML for API or web endpoints

-

From Database for connections to SQL, MySQL, etc.

-

-

In the Navigator or import dialog, preview and select the table or data you want, then choose Transform Data if you’ll clean, or Load to directly bring it in.

Step 3: Transform & Clean the Data in Power Query

Once you’re in the Power Query Editor, you can apply transformations:

-

Remove unnecessary columns or blank rows

-

Rename headers to standard names (e.g. Date, Description, Amount)

-

Change data types (ensure date fields are dates, amounts are numeric)

-

Filter out summary / header / footer lines

-

Merge or append multiple tables if combining data sources

-

Split combined columns (e.g. “Debit/Credit” into separate columns)

-

Add custom columns (e.g. positive/negative logic, categories)

-

Standardize transaction description strings (e.g. strip trailing spaces)

All these steps are recorded as a “query path” that will reapply automatically on refresh.

Once transformation is ready, click Close & Load (or “Close & Load To”) to push your clean data into a worksheet or data model.

From there, you can build pivot tables, charts, dashboards, or formulas.

Step 5: Refresh When New Data Arrives

This is where the automation payoff is real:

-

For file-based sources: drop new transaction files into the folder (or replace existing CSV). Right-click your query table in Excel → Refresh.

-

Excel + Power Query will fetch new data, apply all transformation steps, and output updated table.

-

You can even configure auto-refresh intervals (in some Excel / Office 365 versions) or use scripting to trigger refresh.

Use Case Example: Automating Bank Statement Imports

Let’s walk through a practical example of importing bank statements:

-

Download CSV statements monthly and save to a folder named

BankStatements -

In Excel: Data → Get Data → From Folder, point to

BankStatementsfolder -

Click Combine & Transform Data

-

In Power Query Editor:

-

Promote first row as headers

-

Filter out blank or summary lines

-

Rename columns to

Date,Description,Amount,Balance, etc. -

Convert types (Date, Decimal)

-

Add a custom column to interpret withdrawals vs deposits

-

-

Click Close & Load

-

Each month, drop new CSV into folder → Refresh → table updates

This saves hours of manual copying and consolidates statements seamlessly.

Best Practices & Tips

-

Maintain consistent file naming / schemas: If new files have different columns, your query may break.

-

Use a “template folder”: Keep all transaction exports in one well-structured folder.

-

Version control transformations: Keep track of query steps or document them.

-

Validate after refresh: Occasionally check imported data against the original source to ensure no formatting or mapping errors.

-

Use meaningful column headers: Helps when merging / appending data.

-

Avoid loading unnecessary intermediate tables: Only load the final cleaned query to reduce workbook size.

-

Leverage query folding (when supported by data source) to push filtering and transformations to the server side for performance.

-

Back up your workbook before big changes.

-

Watch refresh limits: Some Excel / Office 365 versions limit auto-refresh or have credential/timeout constraints.

Challenges & Common Issues

| Problem | Why It Happens | Solution / Workaround |

|---|---|---|

| Query breaks when new files have extra/missing columns | Schema mismatch | Standardize schemas; add “if exists” logic or flexible transformations |

| Excel is slow or bloated | Too many loaded tables or large datasets | Only load final data; offload heavy calculation to Power BI if needed |

| API credentials / authentication fails | Tokens expire | Renew credentials; store securely; use OAuth workflows |

| Numeric precision or rounding anomalies | Floating point representation | Use “Fixed decimal number” or round functions |

| Refresh fails due to network / filepath change | Source moved or path changed | Update query’s source path; use constant folder paths |

Emerging Features & 2025 Upgrades to Watch

-

AI-assisted data mapping / transformation suggestions — Excel may suggest data cleanup steps automatically.

-

More connectors (Open Banking APIs, payment gateways) built into Power Query.

-

Scheduled auto-refresh in cloud / Excel web versions improves “always current” datasets.

-

Better integration with business tools (ERP, accounting software) so you can link live transaction feeds instead of manual CSVs.

Conclusion

“Importing transactions into Excel” is no longer a tedious, error-prone task. In 2025, Excel’s Power Query (Get & Transform) gives you a repeatable, robust, automatable pipeline: connect, transform, load, and refresh. Whether your data comes from banks, accounting tools, APIs, or POS systems, you can clean, merge, categorize, and analyze it in Excel with minimal manual work.

If you commit time to set up a reliable import workflow now, you’ll save vast hours later and reduce errors, giving you time to focus on insights, not data entry.