Managing money shouldn’t feel like a full-time job. Yet for many founders, it does. Between card charges, invoices, and subscriptions, keeping tabs on every transaction can be overwhelming.

The good news? You don’t need to hire an accountant or pay for expensive software to stay organized. With the right free tools and a little help from Zaccheus, you can stay on top of your finances, monitor spending, and make smarter growth decisions from day one.

1. Why Founders Need Better Expense Control

1.1 Clear Cash Flow Visibility

Understanding where money goes helps you decide what’s essential, what can wait, and what’s draining your runway.

1.2 Easier Accounting and Tax Season

Organized financial data means no stress during tax filing. You’ll never lose a deductible expense again.

1.3 Professional Credibility

Investors and partners trust founders who can present accurate, transparent financial reports.

2. What to Look for in a Free Financial Tool

When evaluating free software, check for:

-

Receipt uploads or scanning features

-

Automatic categorization for faster reporting

-

Integrations with banking or accounting platforms

-

Export options (CSV, PDF, QuickBooks)

-

Data security and team permissions

If your chosen app can’t generate insights or forecasts, pair it with Zaccheus to get predictive financial guidance without extra effort.

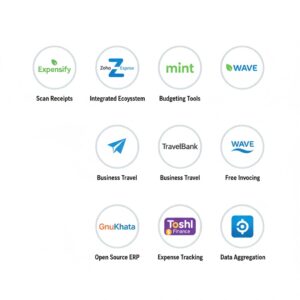

3. 7 Free Tools Every Founder Should Try

| Tool | Highlights | Ideal For |

|---|---|---|

| Expensify | SmartScan for receipts, quick reimbursements, and accounting integrations. | Solo founders |

| Zoho Expense (Free Plan) | Three free users, mileage tracking, and multi-currency support. | Small teams |

| Mint | Simplifies budgets and spending overviews. | Freelancers |

| Wave Accounting | Combines bookkeeping with expense tracking at no cost. | SMEs |

| TravelBank | Expense and travel reporting with unlimited scans. | Mobile founders |

| GNUKhata | Open-source accounting platform ideal for small businesses. | Tech-savvy users |

| Toshl Finance | Great UI, supports multiple currencies, easy analytics. | Global startups |

These tools keep spending organized, but they stop short of giving you financial foresight. That’s where Zaccheus changes the game.

4. How Zaccheus Simplifies Startup Finances

Zaccheus is more than a tracker, it’s an intelligent financial co-pilot that automates analysis and helps founders stay in control.

Here’s What Zaccheus Does Differently

-

Automatic Categorization: Imports transactions from your bank or cards, grouping them intelligently by type and purpose.

-

Real-Time Cash Flow Insights: Understand how current spending affects your future runway.

-

Smart Alerts: Get notified when spending trends shift or unusual charges appear.

-

Budget Visualization: See how much room you have left in each category.

-

Team-Level Permissions: Approve expenses, assign budgets, and manage reimbursements seamlessly.

Zaccheus gives you clarity beyond tracking, it helps you plan, forecast, and grow your startup with confidence.

🔍 Example: One marketing agency used Zaccheus to uncover $600/month in unused SaaS subscriptions, savings they reinvested into client acquisition.

5. Common Money Mistakes (and How to Fix Them)

| Mistake | Impact | Zaccheus Fix |

|---|---|---|

| Forgetting to log small costs | Hidden expenses pile up | Auto-syncs transactions |

| Mixing personal & business funds | Complicates accounting | Separates by category |

| Overspending on tools | Hurts cash flow | Identifies recurring charges |

| Ignoring reports | Missed insights | Delivers weekly summaries |

| No financial forecast | Poor planning | Predicts runway automatically |

6. Conclusion & Sign-Up CTA

You don’t need complex spreadsheets or expensive accounting tools to stay financially organized. Start with these free resources to track your spending and gain structure.

Then, take your next smart step with Zaccheus the AI CFO designed for startups and SMEs that want clarity, automation, and control.

FAQ

Q1: Do I still need an accountant with Zaccheus?

Yes, for official filings but Zaccheus automates 80% of your financial prep, making your accountant’s job (and bill) much smaller.

Q2: Is Zaccheus free to start?

Yes. You can sign up for free, connect your accounts, and access key insights right away.

Q3: What makes Zaccheus better than a simple expense app?

It doesn’t just record transactions, it predicts trends, forecasts cash flow, and alerts you to risks.

Q4: Can Zaccheus integrate with other finance tools?

Absolutely. It connects with accounting apps, banks, and payment platforms for real-time visibility.

Sign up for free at usezaccheus.com to connect your accounts, monitor spending, and forecast growth in minute.