Employee expense fraud can quietly drain your business’s finances and erode workplace trust. It happens when employees falsify or exaggerate claims for reimbursement and if left unchecked, it can cost businesses thousands every year.

Whether you run a startup or manage a growing company, understanding how to spot and prevent employee expense fraud is essential to maintaining financial health and integrity. This guide breaks down the red flags, the most common schemes, and step-by-step prevention tactics your organization can apply immediately.

What Is Employee Expense Fraud?

Employee expense fraud occurs when an employee intentionally submits false or exaggerated claims for reimbursement. This could mean:

-

Claiming ₦50,000 for a client dinner that never happened

-

Submitting a personal Uber ride as a business trip

-

Altering receipts to inflate the amount spent

According to the Association of Certified Fraud Examiners (ACFE), businesses lose roughly 5% of their annual revenue to various forms of fraud, with expense-related cases being a significant portion.

For small Nigerian businesses, even minor fraud ₦10,000 here, ₦25,000 there can quickly snowball into huge annual losses.

Why Employee Expense Fraud Matters for Nigerian Businesses

Expense fraud does more than drain cash. It creates a culture of dishonesty and affects morale among employees who play by the rules.

In Nigeria, where many SMEs operate with tight cash flow, fraudulent reimbursements can lead to delayed salaries, reduced profit margins, and weakened investor confidence.

Preventing employee expense fraud early protects:

-

Cash flow: Keeps every naira accounted for

-

Reputation: Maintains investor and client trust

-

Team integrity: Builds a transparent workplace culture

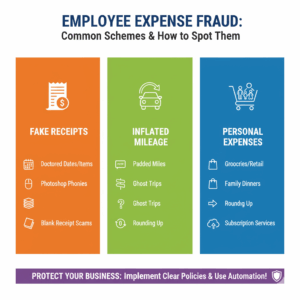

Common Types of Employee Expense Fraud

Here are the most frequent ways expense fraud happens in Nigerian companies:

1. Inflated Travel or Transport Claims

Employees overstate the cost of flights, taxis, or intercity trips. For example, claiming ₦50,000 for a Lagos–Ibadan trip that costs only ₦25,000.

2. Fake or Altered Receipts

Using Photoshop or online tools to modify receipt amounts or create fake invoices from restaurants and hotels.

3. Duplicate Claims

Submitting the same expense multiple times through different reports or months.

4. Personal Expenses Marked as Business

Submitting personal purchases like data subscriptions, family meals, or fuel as “business expenses.”

5. Nonexistent Vendors

Inventing suppliers or services that don’t exist to create fake invoices and get reimbursed.

Red Flags and Warning Signs

Spotting expense fraud starts with paying attention to subtle inconsistencies:

-

Vague or generic receipts that lack details (e.g., “restaurant” with no name)

-

Frequent round numbers like ₦10,000 or ₦20,000 repeatedly

-

Missing or “lost” documentation with poor justifications

-

Unusual expense spikes compared to other staff in similar roles

-

Duplicate entries across months or projects

If these patterns repeat, they’re likely not coincidences.

How to Prevent Employee Expense Fraud

Preventing fraud doesn’t mean mistrusting your employees. It’s about setting clear structures that make fraud difficult and easy to detect.

1. Create a Transparent Expense Policy

Your policy should clearly define:

-

What counts as reimbursable (e.g., transport, accommodation, official meals)

-

What documentation is required (original or digital receipts)

-

Spending limits for categories

-

Approval hierarchy

Keep it accessible through your HR portal or company handbook.

2. Digitize Expense Tracking

Manual expense reporting (spreadsheets or paper receipts) makes fraud easier.

Switch to a digital expense management system that:

-

Requires receipts to be uploaded and verified

-

Tracks approval workflows

-

Flags duplicate or unusual claims

3. Conduct Regular Audits

Quarterly or semi-annual audits help identify repeated offenders or trends.

Look for:

-

High claim frequency from specific employees

-

Missing vendor information

-

Overlapping dates

4. Encourage Whistleblowing and Transparency

Create confidential channels where employees can report suspicious activity without fear.

Anonymous tip-offs often uncover hidden fraud faster than audits.

5. Train Employees on Ethical Spending

Hold short sessions to explain what qualifies as legitimate expenses and why accuracy matters.

A little awareness goes a long way.

How Zaccheus Detects and Prevents Fraud

Zaccheus is an intelligent financial management platform designed for startups, freelancers, and SMEs. It simplifies expense tracking and automatically spots suspicious claims using AI-powered pattern recognition.

Here’s how Zaccheus helps:

-

Automated Expense Matching: Every uploaded receipt is matched to its corresponding transaction for easy verification.

-

Duplicate Detection: The AI flags similar expenses across months or employees.

-

Anomaly Alerts: It identifies sudden spending spikes or unusual vendor activity.

-

Smart Categorization: Automatically classifies expenses into categories like “Travel,” “Meals,” or “Utilities,” reducing manual work.

-

Real-Time Dashboards: Business owners can view all expenses, budgets, and anomalies from one central dashboard.

With Zaccheus, finance teams gain complete visibility over how company money is spent, helping prevent fraud before it becomes a crisis.

Real-Life Nigerian Scenarios

Example 1: The Inflated Hotel Bill

A Lagos-based sales manager submitted a ₦120,000 hotel bill for a client trip to Abuja. A quick check with the hotel showed the real bill was ₦75,000.

Solution: Zaccheus flagged the discrepancy using pattern analysis, leading to a verified audit.

Example 2: The Duplicate Transport Claim

A field rep in Port Harcourt claimed ₦15,000 for “official taxi rides” twice in the same week.

Solution: Zaccheus detected duplicate expenses instantly and prevented overpayment.

FAQs About Employee Expense Fraud

1. What is employee expense fraud?

Employee expense fraud occurs when staff falsify or exaggerate their expense reports to get extra money from the company.

2. How can small businesses in Nigeria prevent expense fraud?

Set clear policies, use automated tools like Zaccheus, and run regular audits to detect and discourage fraud.

3. Can AI really detect fraudulent expenses?

Yes. AI systems like Zaccheus analyze thousands of transactions, detect unusual patterns, and flag inconsistencies in real time.

4. What are common red flags to watch for?

Repeated round-number claims, vague receipts, or expenses inconsistent with job roles are all signs of potential fraud.

5. What should I do if I suspect employee expense fraud?

Investigate quietly, gather evidence, discuss with the employee privately, and apply disciplinary measures if necessary.

Conclusion

Employee expense fraud is a silent threat to Nigerian businesses, especially SMEs with limited financial oversight. But with clear policies, consistent reviews, and AI-driven tools like Zaccheus, companies can stop fraud before it escalates.

Protect your profits, build transparency, and let your finances work smarter not harder.

Ready to take control of your business expenses?

Sign up with Zaccheus today and make employee expense fraud a thing of the past.