Understanding business valuation is crucial for every entrepreneur. Whether you are raising funds, selling your business, or attracting investors, knowing the value of your company can guide strategic decisions. Business valuation provides insight into financial health, growth potential, and market competitiveness. In this article, we’ll explore the fundamentals of business valuation, key methods, and practical tips for entrepreneurs.

1. What Is Business Valuation?

Business valuation is a systematic approach to determining the financial worth of a company. It considers both tangible assets like equipment and inventory, and intangible assets such as brand value, intellectual property, and customer relationships. Accurate valuation provides a realistic snapshot of your company’s position in the market.

2. Why Business Valuation Matters for Entrepreneurs

-

Raising Capital: Investors want to know the value before committing funds.

-

Selling Your Business: Ensures you get a fair price.

-

Strategic Decisions: Helps guide mergers, acquisitions, and expansion.

-

Financial Awareness: Identifies strengths and weaknesses in your operations.

Entrepreneurs who understand business valuation are better equipped to negotiate deals and plan for growth.

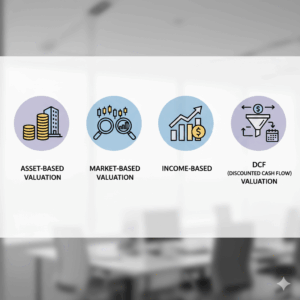

3. Common Methods of Business Valuation

-

Asset-Based Valuation – Calculates the net value of assets minus liabilities. Ideal for companies with significant physical assets.

-

Earnings/Income-Based Valuation – Focuses on the business’s ability to generate profits over time. Often used for startups and SMEs.

-

Market-Based Valuation – Compares your business to similar companies in the industry. Useful for benchmarking and competitive analysis.

-

Discounted Cash Flow (DCF) – Projects future cash flows and discounts them to present value, accounting for risk and growth potential.

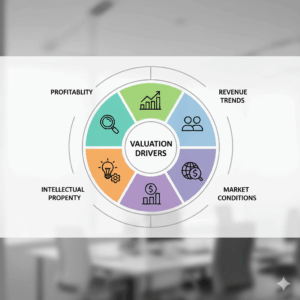

4. Factors That Affect Business Value

-

Revenue and Profit Trends – Consistent growth increases valuation.

-

Market Conditions – Industry growth and competitor performance impact value.

-

Operational Efficiency – Streamlined processes improve profitability and attractiveness.

-

Intellectual Property – Patents, trademarks, and proprietary technology add significant value.

-

Customer Base – Loyal, diversified clients increase stability and market confidence.

5. Common Mistakes Entrepreneurs Make in Valuation

Many entrepreneurs make avoidable mistakes when trying to value their businesses. One common error is relying only on revenue without considering profitability or cash flow. Others overlook market conditions or assume their business will grow faster than it realistically can. Some founders also fail to keep clean financial records, which lowers investor confidence. Understanding these mistakes helps entrepreneurs approach valuation with clearer expectations and more accurate results.

6. Tips for Entrepreneurs to Increase Value

-

Maintain accurate financial records and reporting.

-

Diversify revenue streams to reduce risk.

-

Invest in technology and processes that improve efficiency.

-

Build a strong brand and customer loyalty.

-

Seek professional advice, including accountants or AI-powered tools like Zaccheus, to forecast financial growth and assess potential valuations.

FAQs

1. What is business valuation used for?

It’s used to determine company worth for fundraising, selling, mergers, or strategic planning.

2. How often should I value my business?

At least annually, or whenever preparing for investment, sale, or major expansion.

3. Can startups accurately value their business?

Yes, by using income-based methods, projections, and market comparisons.

4. Does intellectual property affect valuation?

Absolutely. Patents, trademarks, and proprietary technology significantly increase a business’s value.

5. Can AI tools like Zaccheus help with business valuation?

Yes. Zaccheus can analyze financial data, forecast growth, and produce reports that assist in determining a company’s potential worth.

Conclusion

Business valuation is not just a number, it’s a strategic tool for entrepreneurs. Understanding and actively managing your company’s value can help attract investors, negotiate deals, and make informed growth decisions. Leveraging tools like Zaccheus can provide deeper insights, accurate forecasts, and strategic guidance to maximize your business’s potential.

Start using AI tools today to gain clarity on your business value and make smarter financial decisions.